More than 10 years revealing secrets because there is no excuse for secrecy in religion – w1997 June 1; Dan 2:47; Matt 10:26; Mark 4:22; Luke 12:2; Acts 4:19, 20.

written by Miss Usato, August 30th, 2024

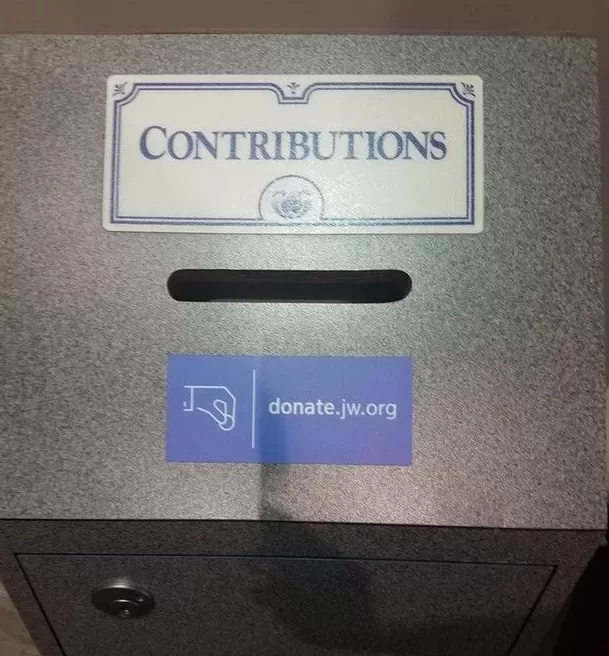

In August 2024, Jehovah’s Witnesses established three new firms in Ireland to handle financial assets and create a strategy for enhancing their financial management capabilities: Mina Asset Management, Mina Treasury Services, and Lepta Payment Solutions. This development highlights the group’s growing financial enterprise and raises questions about the sources and uses of their substantial financial capabilities, predominantly funded by donations from their members. Wooden boxes engraved with the word “Contribution” is a notable feature of every kingdom hall. Since 2000, there have been many forms of giving money to various legal corporations

established by Jehovah’s Witnesses. Recently, they have made additional significant real estate transactions as part of their strategy to liquidate high-value properties. This includes ongoing sales and relocations related to their global headquarters and regional facilities.

The financial backing for these new entities is significant. The Jehovah’s Witnesses are thought to have assets worth tens of billions of dollars, gathered through donations from their members. These voluntary donations, contributed by both Jehovah’s Witnesses and the public,

are used to financially support their global religious activities, including public proselytizing and recruitment, construction of religious facilities, financial investments, disaster relief efforts, as well as funding child sexual abuse lawsuits and certain out-of-court settlements. Contributing to this organization is heavily coerced by their website, videos, publications, and events. They also feature educational videos teaching children to donate their allowance so they are “being generous to Jehovah” ensuring children equate giving to the organization as giving to God. Forms of donation are cash, checks, credit cards, Paypal, real estate, wills, financial accounts, insurance policies and other noncash donations, not to mention the free labor of individual Jehovah’s Witnesses to construct and

maintain their religious facilities

The Jehovah’s Witnesses’ foray into asset management follows significant real estate transactions. For example, in 2016, their buildings in Columbia Heights and the parking lot at 85 Jay Street, NY were sold for a massive $1 Billion.

In 2018, the group sold one of its prime apartment blocks in Brooklyn to a private equity firm for $202 million. These sales are just two examples that were apart of a broader strategy to liquidate valuable real estate assets as the group relocated its headquarters from Brooklyn to a new Warwick, New York facility.

Since then, these real estate sales have also contributed significantly to the organization’s financial reserves, providing capital likely channelled into their new asset management operations. This reflects a strategic shift in how the organization manages its assets, moving from physical real estate to more liquid and potentially higher-yield financial instruments.

When the Jehovah’s Witnesses established these new financial companies, they brought in someone with experience to help manage it.

Philip J. Lofts is a British national born in 1962. For over 30 years Philip Lofts has worked with UBS, a Swiss bank and financial service company. He worked in a variety of executive and management roles including being a member of the Group Executive Board from 2008 to 2015. He was Chief Risk Officer from 2008 to 2010 and then again from 2012 to 2015. In between, he served as CEO of the UBS Americas. While working at the group, he gained international experience from working and living in Europe, Asia, and the US. From 2017 to 2023, he was a Non-executive Directory of UBS Group Americas. In April 2023, he was appointed as a new member of EFG International’s Board of Directors.

When the Jehovah’s Witnesses established their three new financial companies: Mina Asset Management, Mina Treasury Services, and Lepta Payment Solutions in August of 2024—they brought Lofts in to help manage these ventures. His background at UBS suggests that the organization is leveraging his expertise to ensure that its financial operations are conducted with a (high level of professionalism) and strategic oversight, instilling confidence in the audience about the financial operations of the Jehovah’s Witnesses.

Robert Ciranko has been President of the Watchtower Bible and Tract Society of Pennsylvania since 2016. This is one of the leading legal entities used by Jehovah’s Witnesses. He is responsible for various administrative and financial functions. He also oversees and guides the financial operations and strategies related to the Jehovah’s Witnesses’ global activities, including asset management.

Mark L. Questell, also a high-ranking member of Jehovah’s Witnesses, has served as the Secretary and Treasurer of Watchtower Bible and Tract Society of New York. His role involves overseeing financial strategies and operations, particularly those related to the organization’s U.S. activities. He is also a key player in strategically planning the organization’s innovative financial initiatives.

Dr. Tobias Broweleit is a Jehovah’s Witness from Germany. Since 2016, he is a director of Vermögensverwaltung Jehovas Zeugen (Asset Management Jehovah’s Witnesses), a Jehovah’s Witnesses financial entity based out of their Selters Headquarters in Germany. This is also where Jehovas Zeugen K.d.ö.R. (Jehovah’s Witnesses, Corporation under Public Law) is based.” He now lists his address at the World Headquarters of Jehovah’s Witnesses in Tuxedo Park, New York. It is unclear if the organization had sent him to school themselves; but it wouldn’t be the first time Watch Tower had done this. He has a Doctorate (Ph.D.) focused in Business/Managerial Economics from TU Dortmund University. Since 2012, he has served as an Adjunct Lecturer at IU International University of Applied Sciences, teaching Corporate Finance and Performance Management. From 2009 to 2020, he served as a Partner with Broweleit GmbH, that had an address in North Rhine-Westphalia, Germany. As of January 2021, he as re-registered this company in the United States as Broweleit LLC with an address at Jehovah’s World Headquarters in upstate New York. From 2007 to 2009, He worked as a portfolio manager for German banking giant Sparkasse.

In 2017, he conducted videos regarding risk management and accounting for non-profit Organizations. He then wrote a dissertation involving interviews with organizational leaders and directors, focusing on comparative studies or international aspects of accounting and controlling practices. Given that Watchtower has numerous cooperating entities in the UK and Germany, it’s likely that Broweleit leveraged his religious connections to interview staff from Germany and UK Bethels for this dissertation.

His dissertation for the attainment of his doctorate, Risk Management in Nonprofit Organizations, an Empirical Comparison between Germany and Great Britain is found here.

Vassilios Pappas is also a Jehovah’s Witness and a director of Mina Asset Management. Like Broweleit, he is a German national and a member of Jehovah’s Witnesses. He is co-founder and managing director of Assenagon Asset Management, a firm managing around €57 billion in assets.

His involvement in Mina Asset Management suggests that he is leveraging his extensive experience in asset management to help oversee and manage the financial operations of the new Irish ventures linked to the Jehovah’s Witnesses.

Vengethasamy plays a role in their financial management activities in Ireland. He is a director of one of the three asset management corporations that the Jehovah’s Witnesses established in Ireland. These corporations were likely set up to take advantage of Ireland’s favorable tax environment.

His involvement suggests he has a significant role in overseeing the financial strategies of the organization, particularly in leveraging Ireland’s tax benefits for managing assets.

These are the primary legal corporations responsible for Jehovah’s Witnesses’ activities, including publishing religious literature, managing finances, and coordinating international operations. They are headquartered in the U.S.

Watch Tower Bible and Tract Society of Pennsylvania (Robert Ciranko): The Watch Tower Bible and Tract Society of Pennsylvania is a non-stock, not-for-profit organization headquartered in Warwick, New York. It is the primary legal entity used worldwide by Jehovah’s Witnesses “to direct, administer and disseminate doctrines for the group and is

often referred to by members of the denomination simply as “the Society”. It is the parent organization of several Watch Tower subsidiaries, including the Watchtower Society of New York and International Bible Students Association

Watchtower Bible and Tract Society of New York, Inc. (Mark Questell) Inc. Is a corporation used by Jehovah’s Witnesses responsible for administrative matters, such as real estate, especially within the United States. This corporation is typically cited as the publisher of Jehovah’s Witnesses publications, though other publishers are sometimes cited.

International Bible Students Association (Steve Symonds): (IBSA) Was founded in 1914 as a corporation of the Bible Students (as Jehovah’s Witnesses was then known) by Charles Taze Russell in London,

England. The IBSA continues to exist as a legal entity, supporting the work of Jehovah’s Witnesses, especially in areas like religious literature distribution and education.

The Kingdom Hall Trust (Steven Abbott): Another UK-based entity, this trust manages and oversees properties and facilities (Kingdom Halls) used by Jehovah’s Witnesses in the United Kingdom.

WATCH TOWER BIBLE AND TRACT SOCIETY OF IRELAND (Michael White): This is the organization’s Irish branch, handling similar functions to those in the UK and the US but focused on Ireland.

Jehovas Zeugen in Deutschland K.d.ö.R. (Carsten Hinte): The German entity of Jehovah’s Witnesses, recognized as a public law corporation in Germany. It manages Jehovah’s Witnesses’ religious and organizational activities in Germany.

Ireland was chosen by Jehovah’s Witnesses to establish these three asset management corporations because of its favorable tax environment. It has a reputation as a tax haven, offering low corporate tax rates and tax-efficient structures like the “Double Irish” arrangement. These benefits allow organizations to minimize their tax liabilities while managing assets effectively. By setting up in Ireland, Jehovah’s Witnesses could take advantage of these tax benefits, making it a strategic location for managing their financial resources.

Watchtower registered these following domains on July 3rd, 2024 and updated them on August 13th, 2024:

http://mina-am.org

http://mina-ts.com

http://mina-ts.org

Jehovah’s Witnesses seem to becoming more focused on asset management in growing their funds. They see a glaring need to increase their wealth and influence. The fact that they are bringing in top financial experts shows they are serious about ensuring their finances remain vital for the future. These moves raise questions about the ethics and transparency of how religious donations are used, mainly when such funds are being directed into sophisticated financial operations. As the Jehovah’s Witnesses expand their economic footprint, it will be interesting to see how this impacts their global operations and the perception of their members and the public, especially with the recent scrutiny regarding their harsh beliefs on shunning, the baptism of children, their history on child sexual abuse and their policies reporting such abuse and crimes.

Jehovah’s Witnesses currently use Worldpay to process credit card donations. However, one plausible reason for establishing these new entities could be to bring payment processing in-house. This move might be aimed to reduce the significant costs associated with online credit card transactions. With fees potentially reaching 2% per donation, this may amount to tens of millions of dollars in fees each year for the organization. If Lepta is used to handle donation transactions, as is suspected, it may save them millions of dollars each year.

If Lepta is established to process donation transactions, Minas Treasury Services may be created to manage the funds received. Notably, documents reviewed by AvoidJW show that numerous Watch Tower entities worldwide are linked to Minas Treasury Services, including those in the US, Britain, Canada, Denmark, Ireland, Japan, Norway, Sweden, and more. Minas Asset Management, therefore, may have been set up to manage the distribution of assets from credit card donations to various entities across the globe.

Links to aid this article:

Watchtower and Bible Tract Society of Ireland-AvoidJW

Former top UBS executive joins Jehovah’s Witnesses’ new Ireland-based asset venture

2016-The Jehovah’s Witnesses’ Brooklyn holdings

Philip Loft nomination EFG Board of Directors

Tobias Broweleit- Management Framework videos

Tobias Broweleit’s Dissertation with non-profit Organizations

Aiding Transparency to Watchtowers teachings. If you have additional information about this topic or would like to reach the author- Please email [email protected]

Copyright © 2014-2025 An Official Web Site of Jehovah's Witnesses. All rights reserved. Web Site authorized, powered & protected by Jehovah's Holy Spirit. Privacy Policy | Terms of Use