More than 11 years revealing secrets because there is no excuse for secrecy in religion – w1997 June 1; Dan 2:47; Matt 10:26; Mark 4:22; Luke 12:2; Acts 4:19, 20.

Published by: Miss Usato, last updated: December 27th, 2024

Charitable organizations are fundamentally established to deliver tangible benefits to society. In Canada, the Canada Revenue Agency (CRA) applies a public benefit test to ensure that registered charities provide clear and measurable contributions to their communities. The Jehovah’s Witnesses is a registered charity that pays no income tax. However, There have been debates about whether the Watch Tower Society (WT)/ Jehovah’s Witnesses fulfills these requirements.

Under Canadian law, charities can operate for purposes including the relief of poverty, advancement of education, or advancement of religion. While the advancement of religion has historically been presumed to benefit the public, this presumption is not absolute. The CRA’s policy (CPS-024) explicitly states that public benefit must be tangible, socially beneficial, and devoid of harm.

Recent scrutiny of WT Canada reveals that its primary activities involve proselytizing, printing religious literature, and expanding its membership. While this may align with “advancing religion,” these activities offer little direct, measurable benefit to communities. The Church of Scientology is similar, underscoring the risk of assuming public benefit based solely on religious affiliation. Scientology is not a registered charity in Canada. The Church of Scientology has applied for charity status in the past, but the Canadian Revenue Agency (CRA) has denied their application. Like Scientology, Watchtower focuses heavily on internal operations, raising doubts about whether its activities fulfill the public benefit requirement.

Analyzing WT Canada’s financial filings shows significant concerns about its operations. Here are some updates I’ve researched on the organization’s charity status.

2016- of the 86,000 registered charities in Canada, it ranked 18th with more than $80 million in donations.

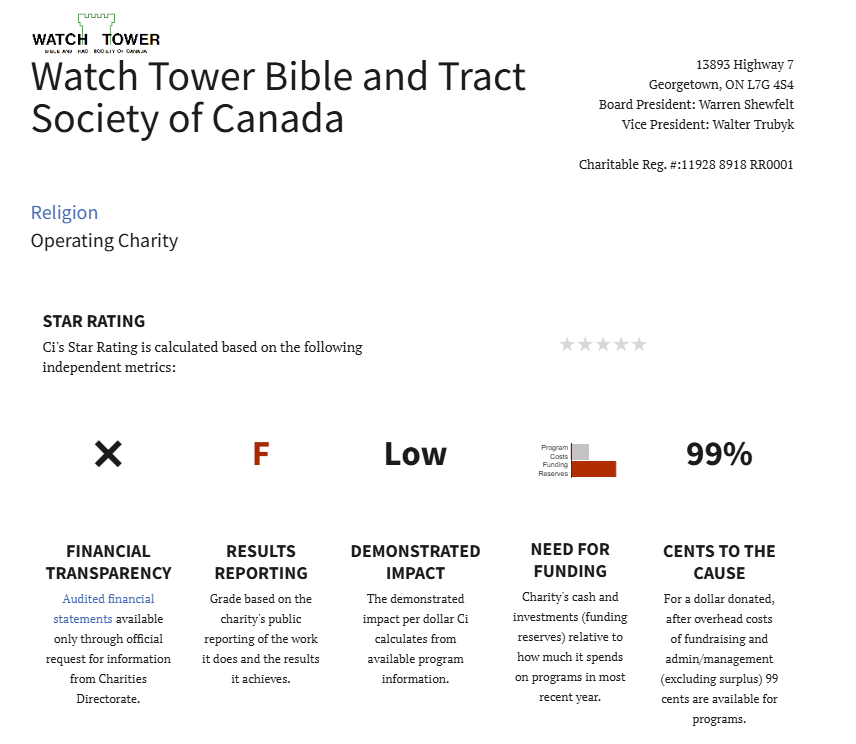

2018- Charity Intelligence, an agency that monitors charities for Canadian donors, gave the Jehovah’s Witnesses a D-grade because they do not provide details on how donations are spent. “Jehovah’s Witnesses have a one-star rating out of five stars. That should be a red flag to donors. That should be a red flag to the government.” – Charity Intelligence in 2018.

2021- WT Canada was still ranked among Canada’s most prominent “charities,” receiving $95.2 million in cash donations. Despite holding assets exceeding $211 million—including $170 million in cash—at this point, the organization has not allocated funds for community aid for more than 50 years. Its T3010 tax returns (Question C16) consistently show no monetary assistance to non-qualified donors, such as local charities, hospitals, or refugee support initiatives.

2022- The Charity Intelligence agency rated the Organization again, stating, “Watch Tower is a 0-star charity with Low demonstrated impact. The charity does not have a website and reports very little about its $30m programs and their results. Watch Tower has large funding reserves and is not financially transparent.”

While WT Canada’s filings mention assisting refugees with accommodation, employment, and education, evidence suggests that individual members, not the organization, bore the costs and undertook the labor. We know this to be true because their site, JwOrg, consistently expresses their members’ divine “love and unity” based on the free labor they give, only giving them a small allowance to survive if they are residents of Bethel. Disaster relief efforts often emphasize rebuilding homes and places of worship but fail to provide transparency regarding any financial contributions benefiting affected communities.

2022-2023, Much of WT Canada’s reported activities center on producing religious literature and videos for distribution. In these years it produced 33.5 million copies of The Watchtower magazine, 41.1 million Bible-based tracts, and 4.9 million copies of Awake! Magazine and 8,500 Bible-based brochures, also translated into numerous languages. The Governing Body tends to boast about how many languages its literature is printed in on JWBroadcasting. I feel these efforts prioritize membership growth over community enrichment. Unlike charities that actively address pressing societal needs, WT Canada’s operations appear insular and self-serving.

As of 2024, there has been no recent news from Charity Intelligence about Jehovah’s Witnesses

Canadian taxpayers indirectly support registered charities through tax exemptions and benefits. These organizations must demonstrate accountability by delivering palpable benefits to society. WT Canada’s long history of accumulating assets without substantial community investment or aid raises concerns about its charitable status. To ensure fairness and uphold the principles of charity, the CRA must critically evaluate organizations like WT Canada. This includes examining whether their activities align with public benefit standards and addressing discrepancies in their financial reporting.

Charity status is a privilege, not a right. It should be reserved for organizations that prioritize the public good over self-promotion. While advancing religion is a recognized charitable purpose, it must be accompanied by demonstrable societal benefits. The Watch Tower Society’s operations in Canada fall short of this mark, calling for a reassessment of its status as a registered charity. Advocating for transparency and accountability in the charitable sector is not an attack on faith but a defense of public trust. Canadians deserve to know that their tax dollars support organizations that make a difference. On that note, Project Straight Arrow is not an officially recognized initiative but a term used in specific discussions and investigations, primarily in accountability and transparency within religious organizations, including the Watch Tower Bible and Tract Society. It refers to efforts by whistleblowers and researchers to advocate change in these organizations’ financial and operational practices, particularly in how they manage funds, claim charitable status, and fulfill their stated humanitarian missions. As of December 2024, Project Straight-Arrow will be completed and submitted to the Canadian Revenue Agency (CRA) early in 2025.

Links regarding Project Straight Arrow

Aiding Transparency to Watchtowers teachings. If you have additional information about this topic or would like to reach the author- Please email [email protected]